Have you ever experienced the frustration of your transactions being rejected in your Solidity smart contracts? Don’t worry, we’ve got you covered.

In this article, we will delve into the intricacies of handling transaction rejection and equip you with the knowledge and tools to mitigate the risks.

Discover the causes behind transaction rejection and learn the best practices for effectively handling them.

Get ready to navigate the world of Solidity with confidence and ensure smooth transactions every step of the way.

1. Key Takeaways

- Transaction rejection impacts blockchain scalability and can cause delays in processing other transactions.

- Ethical considerations should be taken into account when handling rejection.

- Implement transaction rejection prevention measures like input validation.

- Gas limit and appropriate data types minimize rejected transactions.

2. Understanding Transaction Rejection

You should understand why your transaction is being rejected before making any changes to your solidity smart contract. Transaction rejection can have a significant impact on blockchain scalability.

When a transaction is rejected, it affects the overall efficiency of the blockchain network and can lead to delays in processing other transactions.

Additionally, ethical considerations come into play when handling transaction rejection. It is important to handle rejections in a fair and transparent manner, ensuring that all participants are treated equally.

Understanding the impact and ethical aspects of rejection is crucial before diving into the causes of transaction rejection.

3. Causes of Transaction Rejection

If a transaction is rejected, it’s likely due to an invalid input or insufficient funds. Common mistakes in transactions can have a significant impact on the user experience.

Here are some scenarios that may cause transaction rejection:

- Sending an incorrect amount of funds

- Using an incorrect function call

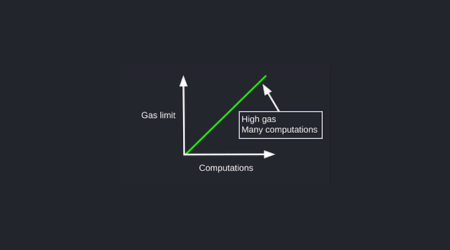

- Not providing enough gas for the transaction

Understanding these causes can help you avoid these mistakes and improve the overall user experience.

Now, let’s explore how to mitigate transaction rejection risks.

4. Mitigating Transaction Rejection Risks

To prevent transaction rejection risks, it’s important to identify and address potential issues in the input and available funds.

Start by implementing transaction rejection prevention measures such as input validation and thorough error handling. Use appropriate data types and ensure sufficient gas is provided to avoid out-of-gas errors.

- Validate Inputs: Ensure data passed to smart contracts is valid and within expected parameters.

- Gas Limit Awareness: Set appropriate gas limits to prevent out-of-gas errors.

- Error Handling: Implement robust error handling mechanisms to gracefully handle rejections.

- Gas Price Estimation: Monitor and adjust gas prices to avoid low-priority transaction rejections.

- Avoid Loops: Minimize the use of loops to prevent potential gas exhaustion.

- Gas-Efficient Code: Write efficient code to reduce the likelihood of rejections.

Now, let’s delve into the best practices for handling transaction rejection.

5. Best Practices for Handling Transaction Rejection

When implementing input validation and error handling, it’s crucial to consider the gas limit and use appropriate data types to minimize the chances of rejected transactions.

To handle transaction rejection effectively, you should follow these best practices:

- Implement transaction rejection notification to inform users about the reason for rejection.

- Use transaction rejection logging to keep track of rejected transactions for analysis and troubleshooting.

- Consider implementing automated retry mechanisms to handle temporary issues causing rejection.

Now, let’s explore the future trends in transaction rejection handling.

6. Future Trends in Transaction Rejection Handling

In the future, you’ll find it beneficial to stay updated on the latest advancements in error handling and validation techniques for smoother transaction processes.

The impact of transaction rejection on user experience cannot be overstated. Rejected transactions can lead to frustration and loss of trust in the system.

Automation plays a crucial role in transaction rejection handling, as it allows for quick identification and resolution of errors, minimizing the negative impact on users.

Stay vigilant and embrace automation to ensure seamless transaction processes.